sacramento city tax rate

To review the rules in California visit our state-by-state guide. Has impacted many state nexus laws and sales tax collection requirements.

Investment Properties Adelaide Best Investment Properties In Adelaide Investment Property Real Estate Investing London Property

55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer.

. The Sacramento County sales tax rate is 025. Did South Dakota v. For questions regarding the status of your application or renewal you may contact Revenue Services Monday 100 pm - 400 pm and Tuesday - Friday 830 am to 400 pm at 916 808-8500.

California has a 6 sales tax and Sacramento County collects an additional 025 so the minimum sales tax rate in Sacramento County is 625 not including any city or special district taxes. The statewide tax rate is 725. Business Permit Forms and Instructions.

The minimum combined 2022 sales tax rate for Sacramento California is. The County sales tax rate is. The Sacramento California sales tax is 825 consisting of 600 California state sales tax and 225 Sacramento local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

This table shows the total sales tax rates for all cities and towns in. Home-Based Business Information pdf and Permit Application pdf Burglar Alarm System Permit. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County.

The total sales tax rate in any given location can be broken down into state county city and special district rates. This tax has existed since 1978. Those district tax rates range from 010 to 100.

Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 24 05 galt city of 26 06 citrus heights city of. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. They can be reached Monday 100 pm - 400 pm and Tuesday - Friday 830 am to 400 pm at 916 808-1202.

This is the total of state county and city sales tax rates. Please contact 916 874-7833 or TaxPpropsaccountygov for the. The December 2020 total.

Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax. All are public governing bodies managed by elected or appointed officers. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business.

Select the California city from the list of popular cities below to see its current sales tax rate. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. T he tax rate is.

4 rows The current total local sales tax rate in Sacramento CA is 8750. Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 22 05 galt city of 24 06 citrus heights city of. Sacramento county tax rate area reference by primary tax rate area.

For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. Tax Collection Specialists are available for customer assistance via telephone at 916 874-6622 Monday Friday from 900am to 400pm or via email at TaxSecuredsaccountygov for the Secured Tax. The Sacramento County Sales Tax is collected by the merchant on all.

California has recent rate changes Thu Jul 01 2021. After your business receives zoning approval you will be mailed a business operations tax certificate. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 24 05 galt city of 26 06 citrus heights city of. The most recent secured annual property tax bill and direct levy information is available online along with any bill s issued andor due in the most recent fiscal tax year through e-Prop-Tax Sacramento Countys Online Property Tax Information system. With local taxes the total sales tax rate is between 7250 and 10750.

Revenue and Taxation. How do you calculate transfer tax in California. This tax is charged on all NON-Exempt real property transfers that take place in the City limits.

11 rows 025 to county transportation funds. You may also contact us electronically. Property information and maps are available for review using the Parcel Viewer Application.

Some areas may have more than one district tax in effect. 075 to city or county operations. What is the sales tax rate in Sacramento California.

Sacramento county tax rate area reference by primary tax rate area. This includes Secured and Unsecured supplemental escaped additional and. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax.

The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025. The California sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v.

The Sacramento sales tax rate is. Permits and Taxes facilitates the collection of this fee. The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

Utility User Tax Ordinance pdf. 1788 rows Sacramento. Automating sales tax compliance can help your business keep compliant with changing sales tax laws.

Pin On Mapas Planos E Infograficas

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

How Rich Is Too Rich Data Visualization Design Information Visualization Data Visualization

15 Of The Cheapest Places To Buy A House In The U S Michigan City City Guide Real Estate

I Put This Flyer Together For Blueseed To Distribute To Attendees At The November 2011 Founder Sh International Waters Background Information Startup Incubator

Sacramento County Sales Tax Rates Calculator

15 Of The Cheapest Places To Buy A House In The U S Real Estate House Investor Real Estate Marketing

Column Five Media Turbotax Infographic America S Most Bizarre Taxes

Sacramento California Tourist Spots Google Search California Tourist Spots Sacramento Valley Sacramento Airport

Column Five Media Turbotax Infographic America S Most Bizarre Taxes

Pin Pa Why Is Capital Poor And The Worker Losing Fn

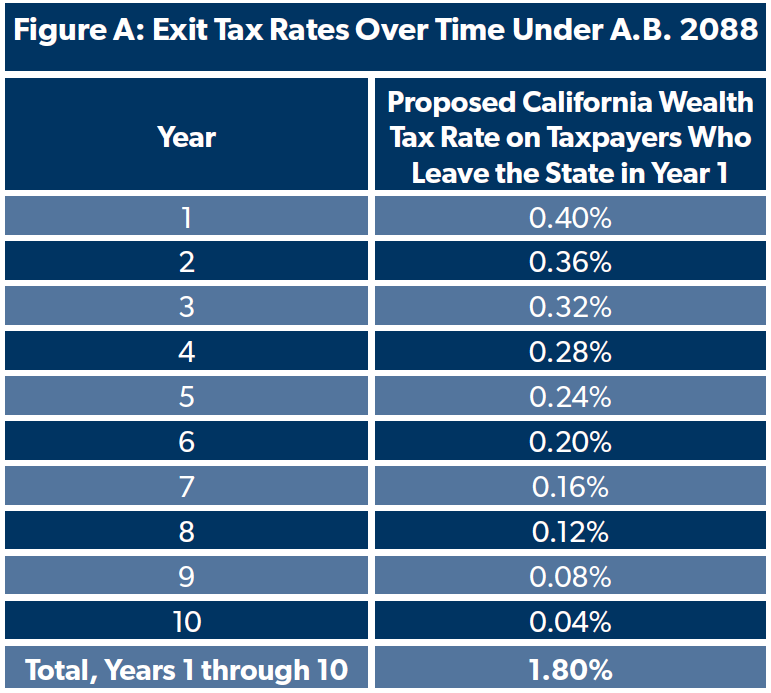

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Credit Repair Sacramento Credit Repair Sacramento Financial Goals

Real Estate Investing Investing Real Estate Rentals

The Fight Over Funding To Combat Homelessness Is Heating Up In Sacramento California S Big City Mayors Comprised Of Mayors Vacation Vacation Home Tax Refund

10 California Cities Saving Money With Led Street Lights Led Street Lights Street Light California City

If You Are Renting A Home At 1600 A Month In Sacramento You Could Break Even On That Amount In Only 1 Year And Rent Vs Buy Buying A Condo Las

Sf V Nyc Business Infographic Infographic Educational Infographic